When Jenn Burruss got home from work last Wednesday, she started cooking dinner and opening mail. She saw her annual homeowners insurance renewal notice and shuffled it to the bottom of the pile.

When she finally opened the notice, it laid bare a painful question: Could she, a single woman raising three kids, afford to keep her house?

Last year, the premium to insure her home in Hickman, a city of 2,600 people south of Lincoln, was just over $1,400. Now, it would be almost $2,900.

“I am terrified,” she told the Flatwater Free Press, noting her property taxes also are increasing. “I don’t know how long I will be able to stay there.”

Steep increases in homeowners insurance premiums have become common in Nebraska.

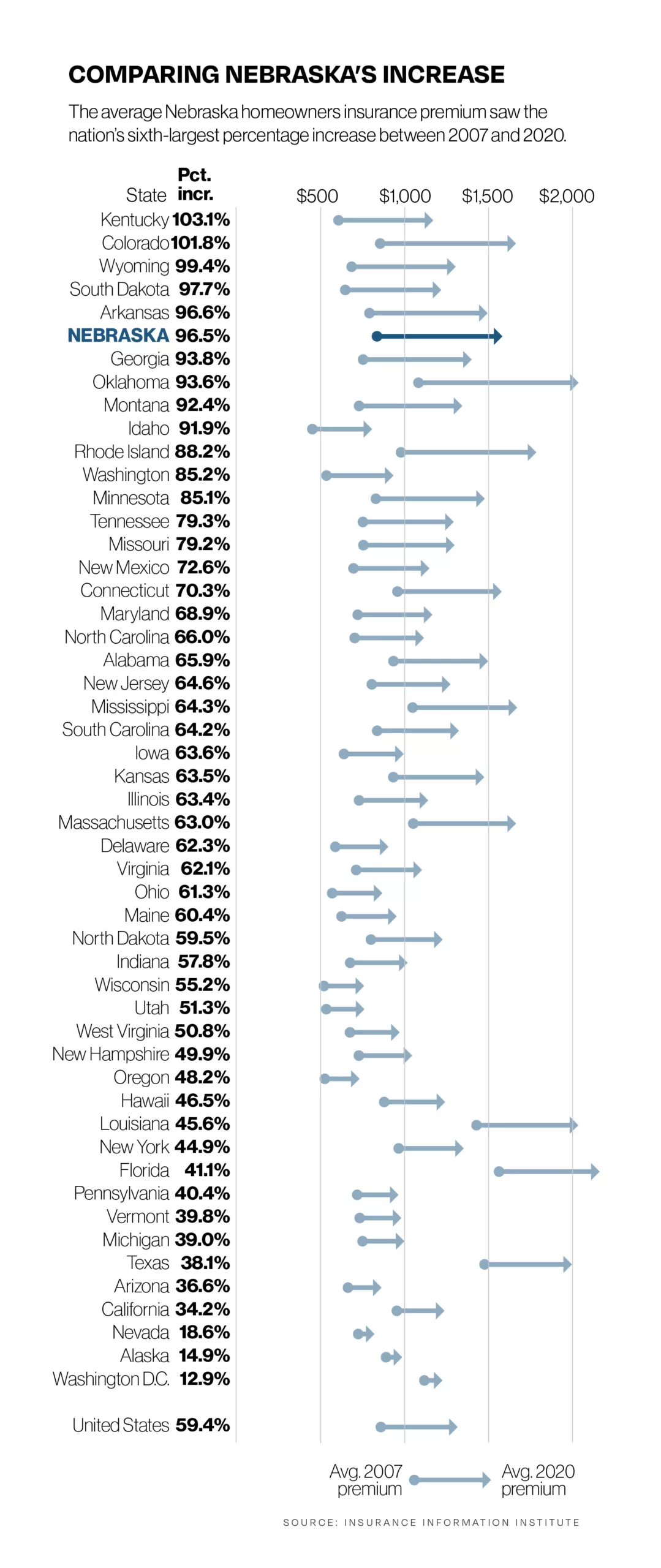

On average, Nebraska homeowners paid nearly twice as much to insure their homes in 2020 as they did in 2007, a sharper increase than most other states, according to data provided by the Insurance Information Institute.

A recent analysis from PolicyGenius found the average premium in Nebraska this year for $300,000 in dwelling coverage is about $3,500, double the national average and the second-most expensive in the country.

“Much of the increase (since the pandemic) can be attributed to supply-chain issues and labor shortages, which are driving up the cost of home repairs and replacement,” said Scott Holeman of the Institute. “But longer-term trends also affect rates.”

The key long-term culprit in Nebraska, according to industry experts and local agents, has been more severe weather events – a byproduct of climate change.

“Instead of just replacing a roof or some broken windows, they are now having to rebuild entire communities from the ground up,” said Jane Egan, who has sold insurance primarily in Lancaster County for four decades. Those events have left companies with no choice but to raise rates, she added.

Nebraska’s temperatures have risen more than 1.6 degrees Fahrenheit since the start of the 20th Century, according to the National Oceanic and Atmospheric Administration.

Former Nebraska State Climatologist Martha Durr said that the state also is seeing more precipitation on an annual basis, while swings from wet to dry are getting stronger: Wet times are wetter, dry times are drier.

Data for hail and wind is more complicated, Durr said, because it relies on people submitting reports. But, a warmer atmosphere holds more moisture, which amplifies the “ingredients” for severe storms and can result in more extreme weather, Durr said.

“In what we can tease out from the information that we have, it looks like the events are getting stronger and there’s more damages associated with these events,” she said.

The number of weather and climate disasters that have caused at least $1 billion in losses and affected Nebraska has been rising for decades, according to data from NOAA. In the 1990s, Nebraska was affected by four of those events, total. In the last five years alone, it has seen 17.

More intense storms can cause more damage and increase the number of claims, according to Jamie Chung, professor of finance, banking and real estate at the University of Nebraska at Omaha.

Insurers look at how often these storms happen when they do their modeling, said Scot Kibbe, vice president of state government relations for the American Property Casualty Insurance Association.

“Those models are just being thrown out the window the last few years, because it’s changed so much because there’s so many more of these events – throughout the country, and obviously in Nebraska, too,” he said.

Egan said she started noticing an uptick in premiums in coastal states after Hurricane Katrina devastated New Orleans in 2005. Agents knew the increases would eventually spread, she said.

“And then, as climate change has intensified the frequency and strength of these storms … we were getting messages directly from our insurance carriers that premiums were going to have to be adjusted pretty dramatically.”

Chip Bullock, an agent in central Nebraska for two decades, said he’s seen premiums increase rapidly in the last few years, by between 10% and 40%.

Previously, he saw typical increases tied to inflation and property values. But Bullock said the last two years in particular brought “unbelievable” increases, mostly due to hail and wind.

Other factors also are driving premiums up: inflation, the cost of materials to rebuild, the cost of reinsurance (insurance for insurers), rising home values and the cost of lawsuits against insurers. In some states, the regulatory environment is a factor, though that doesn’t appear to be an issue in Nebraska.

Broad economic factors have ups and downs, but there’s no end in sight for climate change, said Don Hornstein, a professor at the University of North Carolina School of Law.

Some well-known insurers have pulled back or stopped selling new homeowners policies altogether in states hit particularly hard by disasters like wildfires and hurricanes, such as California, Colorado, Florida and Louisiana. Companies have changed their offerings here, too.

“Insurance companies, right now, really don’t want a lot of new business,” said Bullock.

Nebraska Department of Insurance Director Eric Dunning said in an email that Nebraska hasn’t “seen the broad pullback from writing new business” that some other states have seen. But he said some companies have increased minimum deductibles overall – specifically for roofs – while some have required more than cosmetic damage before they’ll pay for specific repairs.

The department is “having conversations” with one carrier that increased its underwriting standards for new business, he said.

Four major insurance companies – Nationwide, Allstate, State Farm and Liberty Mutual – either didn’t respond or declined to answer questions about policy changes in Nebraska.

A Nationwide spokesperson pointed to a June press release that blamed “the economic environment, catastrophic weather events and the impacts of inflation” for “business actions” it’s taking to reduce risk.

Dunning said that rate increases affect most Nebraskans, and he suggested people shop around.

“While shopping for insurance is seen as a chore by most people, there are significant differences between the rates charged by specific insurers,” he said. “Contacting independent agents, direct writers and agents for one company is a great way to shop.”

But Egan cautioned against changing carriers. Increases are happening across the board, she said, companies are getting very picky about who they take on, and sticking with a company long term could make them less likely to dump you if you have a claim.

“People get afraid and they start jumping … not knowing they’re really putting themselves in peril because the following year they’re going to get hit again — either with a cancellation notice because of a loss or because that company hasn’t caught up and passed along rate increases that are inevitable,” she said.

Ann Ames, CEO of Independent Insurance Agents of Nebraska, said the right move – to stay or go – probably differs on a case-by-case basis, and that homeowners should talk to their agent about what’s best for them.

The industry has noticed an increase in homeowners who aren’t paying a mortgage and choose to opt out of coverage entirely, Hornstein said, leaving their most valuable asset exposed.

“They’re just rolling the dice, and it’s understandable because a lot of them simply don’t have the money,” he said.

Rising premiums also could push homeownership out of reach for some first-time buyers.

The higher costs of insurance – a requirement for most mortgages – weigh especially heavily on people with lower incomes, said Chung, the UNO professor.

“Housing prices have increased a lot, and increasing the homeowners insurance premium also could prevent (lower-income people) from getting a mortgage, too,” Chung said.

Homeowners may be able to lower their costs by shoring up their homes against severe weather. Sometimes, insurers offer discounts after certain improvements.

Find your risk factor

The nonprofit First Street Foundation has created an online tool called Risk Factor where people can type in an address and see estimates of that location’s risk of wildfire, flood, wind and heat.

Some homeowners have elected to increase their deductibles in order to lower premiums. That includes Burruss, who said she was able to knock a couple hundred dollars off her new premium as a result.

But that’s not enough to take away the stress of last week’s news. She’s now looking at ways to cut any extra spending, so she can try to keep her kids in the community she loves.

“(Hickman is) the most wonderful place, and I love it,” Burruss said. “I have tried my best to be able to keep my kids with their friends at their school. But I don’t know how much longer I can do it for.”

The Flatwater Free Press is Nebraska’s first independent, nonprofit newsroom focused on investigations and feature stories that matter.

10 Comments

I’d like to know the percent that each of these things caused the insurance rates to go up. Higher claims and risks because of Climate change, cost of materials, profits of the insurance companys.

State Farm lost $13.4 Billion in 2022. This year isn’t looking much better. Farmers Mutual lost in 2022 75% of everything they made from 2016-2021. Until Bidenomics is fixed, and inflation is under control, it’s going to be ugly.

The entire insurance industry is something of a scam. Did you know that the NE State Insurance Commissioner is there to help ensure the insurance companies remain solvent and not to help represent the public’s interests in trying to keep rates affordable? That’s right, each year the insurance companies need to justify their rates. They keep most of their assets invested in the stock market and other investment vehicles. When the markets go down or they make poor investment choices, guess who ends up paying with higher rates?

As long as home valuations and property taxes skyrocket, Homeowners Insurance will also soar. It is not hard to understand why when you look at who benefits; Nebraska cities, public schools, counties and banks. Adding insult to injury, we pay the 11th highest taxes and when Nebraskans die, the state swoops in to kill us again with estate taxes. It is getting impossible to live or die in Nebraska.

Our homeowners premium has doubled since 2016. When our roof had to replaced last year due to hail damage I asked our carrier if we would get a decrease in premium if we paid $10,000 more out of pocket for a hail resistant roof. They said no. In light of climate change causing more violent weather I think a tax deduction should be available for homeowners paying for hail or wind resistant roofs.

Pays to shop around. I just got my premiums cut in half by switching. I’ll check prices every few years to see if I can get a better deal. Please state if the billion dollar event graph is adjusted for inflation.

Good,l story but sad situation.

I would like to hear from our U.S. Senators and Reps along with the Governor and state legislators as to what their recommendations will be.

As most are Republicans who say there is no climate change or changing climate conditions.

I see there is no mention of the prices of homes escalating especially in the last two years. New builds are one thing, standing homes are another. There are many factors that go into the price, or rising price, of homes. climate change not so much. Populations have increased so there is more to insure. I seen less snow in the last twenty years in Nebraska than my first 20. I never even put gas in my snowblowers last year. All these “terrible” winter storms. I lived in ND in 1975. Sat through the blizzard of the century for 3 days. The next week, another 2 day blizzard. Haven’t seen anything like it since. The climate change. Does man affect it, sure. How much? No one really knows. The models are incomplete and can not even predict past weather. Way too many variables. It may be an easy answer but not nearly the whole answer. The words climate change seem to stop any need for further investigation. But that is how it is today.

Insurance company’s will use any excuse to raise rates and they will use the green new scam to try and justify their higher rates. I have insured my house(s) for over fifty years and I have switched carriers many times, and I always check rates with other carriers at least every two years. Higher Insurance rates coupled with the large proposed real estate increase(Nebraska ranks 7th in the USA) coupled with high inflation and probably a recession will make us scrape the bottom of our savings. Also don’t count on the Nebraska Department of Insurance to do anything meaningful to lower your rates. The last time I talked to them they told me that, essentially, they go by whatever the Insurance actuary’s tell them. Nebraska is really the good life-only if you can afford it. Just say NO to government.