One August morning, I noticed an envelope with first class postage – postal speak for Potentially Important – from a bank where I do not bank, sandwiched between the bills and the junk mail.

Inside, I discovered some potentially exciting news indeed: I’d overpaid a credit card balance, closed the account and Citibank owed me.

All I needed to do was complete the enclosed claim form and wait for my windfall.

If they didn’t hear from me soon, they’d turn my assets over to the place where lost rebates, insurance company credits, errant paychecks and dormant credit card overages go to live: the Unclaimed Property Division of the Nebraska State Treasurer’s Office.

Those assets Citibank owed me? Exactly enough to pay for the stamp to mail the claim back: 60 cents.

After I rolled my eyes and read the letter again, I decided to save my stamp, and endeavored instead to find out more about the place set to receive my pittance.

And to see what they would do with it.

***

The Unclaimed Property Division of the Nebraska State Treasurer’s Office wants us to have our wayward money.

They call it property, although it’s almost always cash.

“It’s a rebate you filed for and never thought about again,” says Meaghan Aguirre, the division’s director. “A utility deposit you forgot about. It’s found money, even though it’s your money.”

It’s big money from an insurance policy. It’s chump change from a banking error. It’s the treasure inside Grandma June’s abandoned safety deposit box.

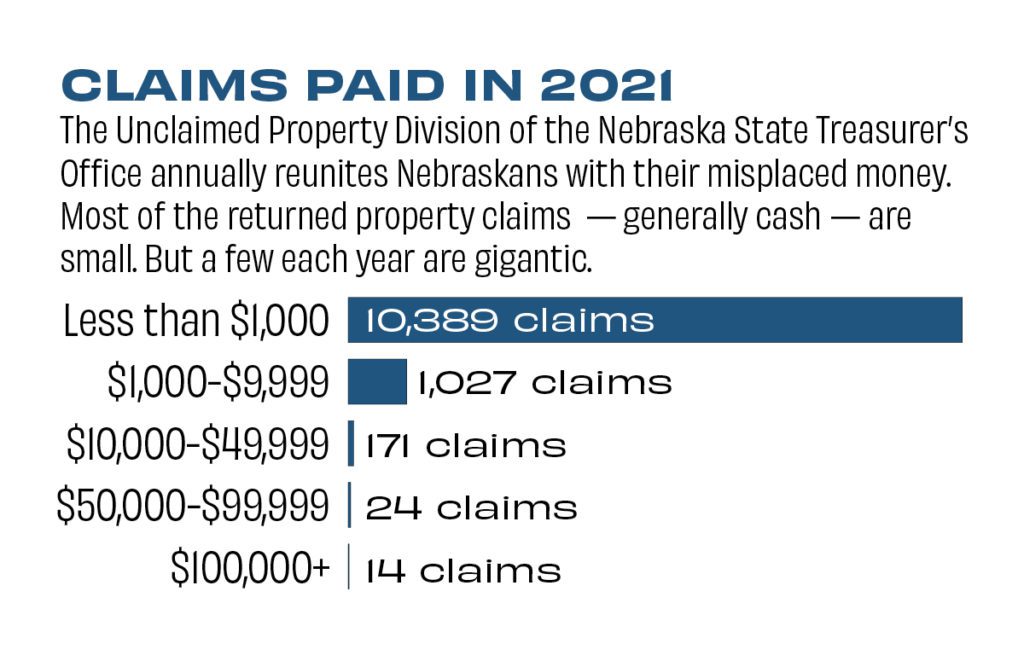

Every state has a system to collect and disperse property due its citizens, required by consumer protection laws. Businesses and banks report and transfer abandoned funds and Aguirre’s office publishes a list of lucky winners online and in 16 of the state’s biggest newspapers.

Every county is represented in the 2022 broadsheet that landed on doorsteps from Omaha to Scottsbluff last spring. In Douglas County, 10 pages and thousands of names; in Arthur County, population 439, a single potential recipient. (Mr. Cone, if you’re out there, the treasurer’s office has your money.)

Alongside the names of all those people, in very small print, are auto repair shops, bakeries, jewelry stores, co-ops, hair salons, political campaigns, volunteer fire departments, nonprofits and corporations.

The Shamrock Livestock Market. The Nebraska Trucking Association. The woman with the same name as my sister, who is (sadly) not my sister.

There’s Pete Ricketts for Governor Inc. There’s the Bellevue Chamber of Commerce.

There’s my best friend Susan, who now has a $60 check coming and is rewarding me with a coffee date.

Unclaimed Property is the Santa Claus of state agencies. It doesn’t raise your taxes or hassle you to license your car.

It’s not the Powerball, but the odds of winning are much better.

The math: One in five Nebraskans.

Median payout: $95

“If you don’t have unclaimed property, you likely know someone who does,” Aguirre says. “It’s your money; we’re just the custodian.”

Courtesy photo

Aguirre is in charge of seven employees in Lincoln and Omaha who verify claims, catch fraudulent ones, sleuth out heirs with the help of databases and shoe leather and share the good news with postcards and letters you should not toss.

“If you get something from us,” Aguirre says, “it’s legit.”

The office has a success rate far better than Husker Football: 75 percent if they have a Cornhusker resident and a Social Security number her staff can work with.

This year, Nebraskans have already been reunited with nearly $13 million, thanks to a $5 million investment account reported as dormant by T.D. Ameritrade. (Turns out, the owner knew he had it, but he’d hadn’t fiddled with it in years and moved, leaving Potentially Important letters from Ameritrade unanswered.)

It takes a $50 payout to make the print version. The division’s online database – nebraskalostcash.gov – starts at $15. The couch cushion category ($14.99 and under) doesn’t show up, but stays in the system until it can be added to a bigger pot of cash from a future accounting blunder or misplaced inheritance from Great Uncle Al, who always loved you best.

Once you and your property make the list, you stay on it for all eternity. Or until you, or an heir, finally claim what’s yours.

At this moment, $200 million of our dollars are waiting.

Get on it, Nebraska.

***

The Lincoln man had $65,000 coming to him.

But he didn’t seem to care.

He ignored letters from the treasurer’s office.

He ignored phone calls.

“I couldn’t get him to claim it, couldn’t get him to claim it,” said Mary Jones, an unclaimed property research specialist.

For 18 months, she kept calling. She put it on her calendar. Every Thursday, the man’s office manager said the same thing: She’d relay the message.

What did Jones hear back? Crickets.

Then she noticed something new as she toggled the Internet: The man and his wife were no longer registering vehicles together. The wife had a new address in Arizona.

“I thought, ‘OK. I bet he’s ready to get the money now.’”

The newly divorced man was. “He finally filled out the paperwork and submitted the claim.”

Jones is working on another reluctant recipient now. An Omaha man with $19,000 and change coming to him, along with a safety deposit box holding three silver bars.

“I’ve been trying to get him to come in for years. It’s just not a priority for him.”

Those are the outliers, Jones says. Most people – when they find out the postcards and letters aren’t a scam – are happy to be reunited with money they didn’t know they’d lost.

Like the family who received $336,000 in life insurance benefits and investments after the death of their mother. “They were totally unaware of these funds.”

And the grown children who hauled their mother’s casket in the back of a pickup to the mortuary, but were able to pay off her funeral expenses when a claim showed up with their dad’s name on it.

Jones loves her work – equal parts detective, paper-pusher and good fairy.

It’s the people, she says. Someone with a new baby or a crappy car, delighted to hear they have money coming their way.

It’s the Plattsmouth man who called last week to verify his claim – proceeds of a forgotten life insurance policy.

“He thanked us and said the check was going to come in time to pay for his new dentures.”

***

Al Hagemeier had been on the list for years. “Somebody told me they saw me there once, but the paperwork seemed too complicated.”

This year, with a little prompting from a Flatwater Free Press freelancer, the Garfield County retiree tried again. He made a phone call. Answered a few questions. He learned his name was on the list more than once, his wife Donita said. Verifying it was easy as pie.

After he signs the paperwork, Hagemeier will be getting enough moola for a new tractor blade. “He’s pretty excited.”

Marcie Young was pretty excited when found herself on the list several years back.

“It was about $1,000,” the Lincoln financial adviser said. “I was thunderstruck.”

She’d forgotten she’d once had a credit card that deposited a percentage of purchases into a college fund. She spent her unexpected treasure, but not on her daughter’s tuition. “She didn’t end up going to college.”

Katherine Endacott came into some cash in the 1970s after discovering the father of a high school friend had bought a racehorse and put her name on the title. Both the horse and the father died – and Endacott’s share made its way from Kentucky to Nebraska’s Unclaimed Property Division.

“I didn’t get rich,” the Pleasant Dale woman said. “But it makes a good cocktail party story.”

The 2022 party includes: Chris Dinan, who snagged $286 from an unclaimed 2014 paycheck from Arby’s. Tina Dykes, due $342 from an overpayment for dental work.

Monica Kruger, awaiting $20.44 from an unclaimed rebate. Her daughter will soon be $102 richer. “From the Y, where she used to be a lifeguard.”

Kruger also discovered her mother-in-law, brother-in-law and a pair of friends in the online database.

“And I told them to check, too.”

Julie Cook has done her share of checking. Years ago, the Lincoln woman started scouring the list, looking for her name (never there). She looked for friends, relatives, clients of her cleaning business. Strangers.

Back then the phone book could double as a detective device.

“I called when I had a few extra minutes. I’d tell them my name and that it was a hobby. They all seemed pleasantly surprised.”

Once an older man found out he was due an insurance payout.

If I get a million dollars, I’ll look you up, he said.

***

Since the division was created by state statute in 1969, it has reunited Nebraskans with $240 million. Many millions arrive electronically each year – the bulk in November, when businesses report. Then it heads back out to Nebraskans who claim it, a revolving door of funds that never dwindles to nothing.

Every October, the department deposits most of what’s left in the coffers into Nebraska’s Permanent School Fund, which funds “support and maintenance” of public schools. It’s deposited an average of $12 million the past four years.

And the cycle starts all over again.

“We’re always getting in more than we’re transferring out,” Aguirre said.

Including my 60 cents.

Its fate?

If I really really want it – if I insist – I can have it, Director Aguirre said.

But…

“We’d be spending more to send you that payment than it is worth.”

2 Comments

Why on earth would you not include a link to their website?

Hey, Bridget. The link is in the story. (Good luck finding some cash!)